.jpg)

If you are a VAT registered Irish business owner you can set up a VAT free account with us, allowing you to purchase goods and items from our online store without paying the VAT. In order to do this you FIRST need to set up a business account with us and provide relevant details so that we can have them checked by the HMRC.

Please note: Once you set up a business account we need to manually approve the account. This can take up to 1 working business day. DO NOT purchase before receiving a verification email - or you will be charged VAT which we CANNOT refund. We can only deliver to the VAT registered address.

For personal customers living in VAT exempt states such as Jersery, Gurnsey, Switzerland & Norway you will need to set up a personal account BUT documentation is not required as we are shipping to the state address. You must ensure that your address registered against your account for both billing and shipping are located within these VAT exempt states or else you will not see VAT exempt prices online.

-----------------------------------------------------------------------------------------------------------------------

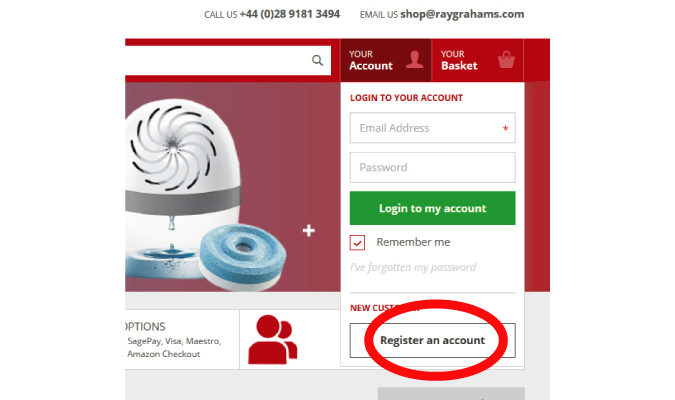

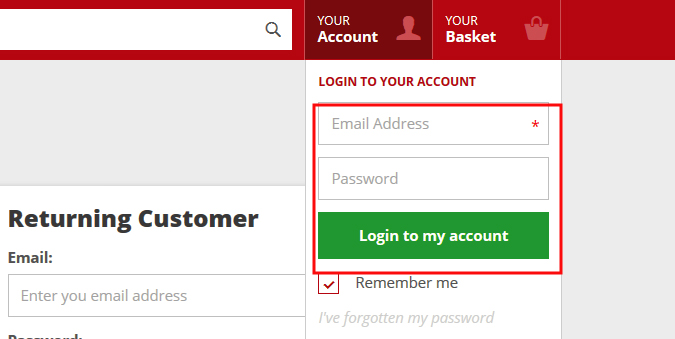

Step 1: On our site homepage (www.raygrahams.com) at the top of the page, to the right of the search bar select 'YOUR ACCOUNT'.

.jpg) Step 2:

Step 2: Select register an account.

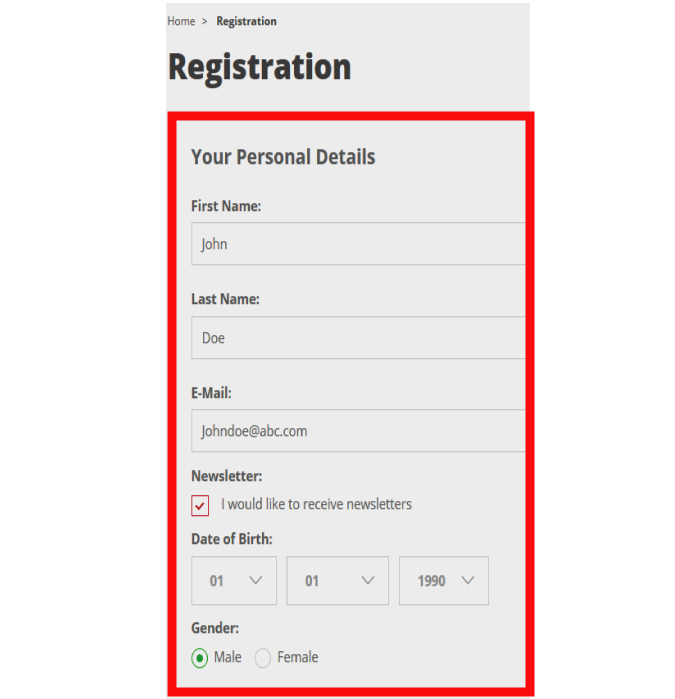

Step 3:

Step 3: Fill in your personal details.

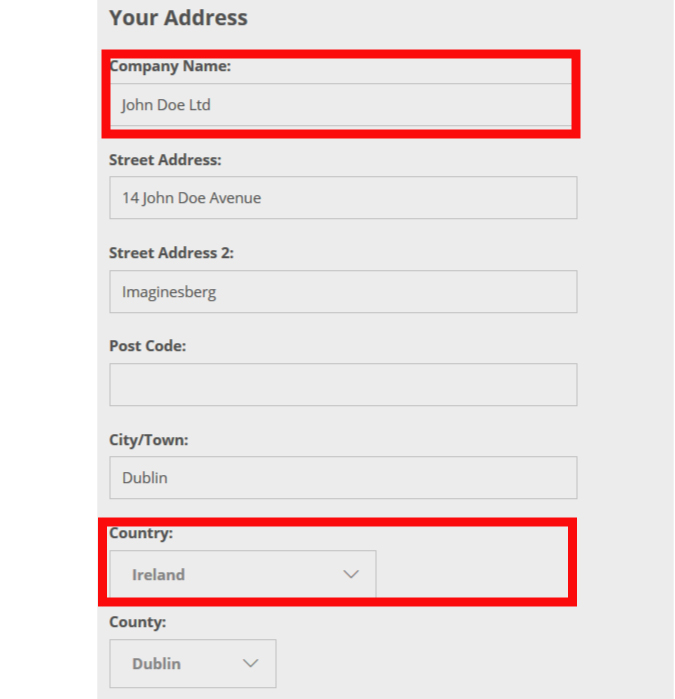

Step 4:

Step 4: Fill in your address details. You MUST enter a company name and the country must be outside of the UK in order for the site to provide the option of having a VAT exempt account.

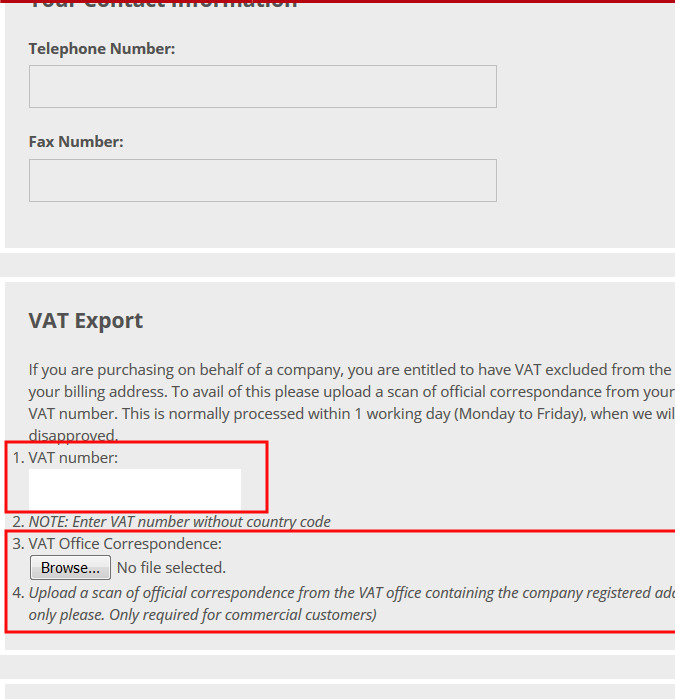

Step 5:

Step 5: Finish completing your personal details including contact number. Under this section you will see a section marked 'VAT EXPORT'. This is the important step.

1) Enter your business VAT number.

2) Upload a copy of your VAT correspondence - This MUST be an official copy of correspondence from your relevant VAT Office. For example a VAT end of year or a VAT return form. It must contain the following - Business name - Business Address - VAT No - VAT office watermarked heading.

Please note: We only deliver to the business VAT registered address.

Step 6:

Step 6: Choose a unique password & re-confirm.

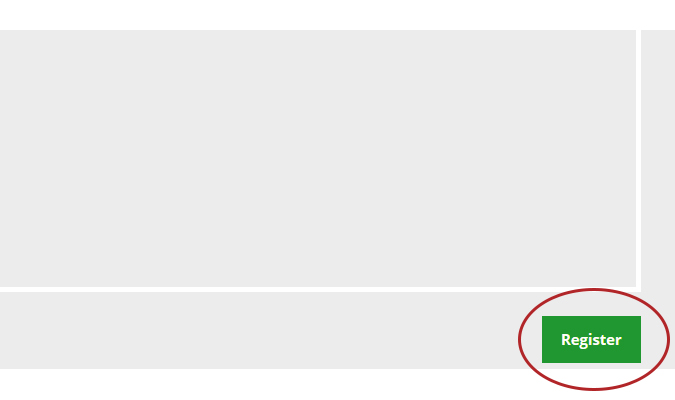

.jpg) Step 7:

Step 7: Click register at the bottom of the page.

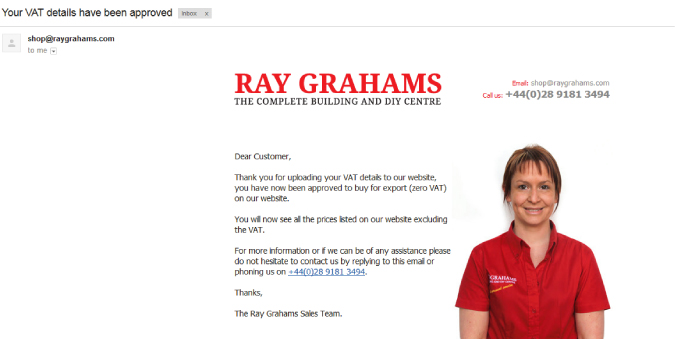

Step 8:

Step 8: Once processed by a member of our team you will receive a confirmation email.

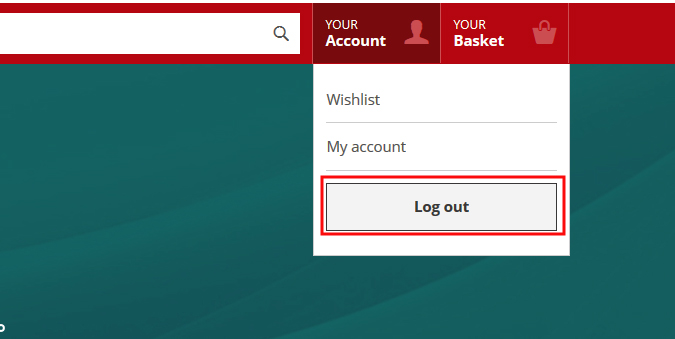

Step 9:

Step 9: Once the confirmation email is received. Log out of your account. This is important as you will not see the VAT excluded prices.

Step 10:

Step 10: Log back into your account.

Step 11:

Step 11: You will now see the VAT exempt prices.

Please note: Prices listed in euros are subject to change. They are a rough guidline price based on the current euro conversion rate, however these prices can fluctuate slightly depending on the payment method used. All online orders are charged in sterling (GBP).